In this issue

May 11, 2017

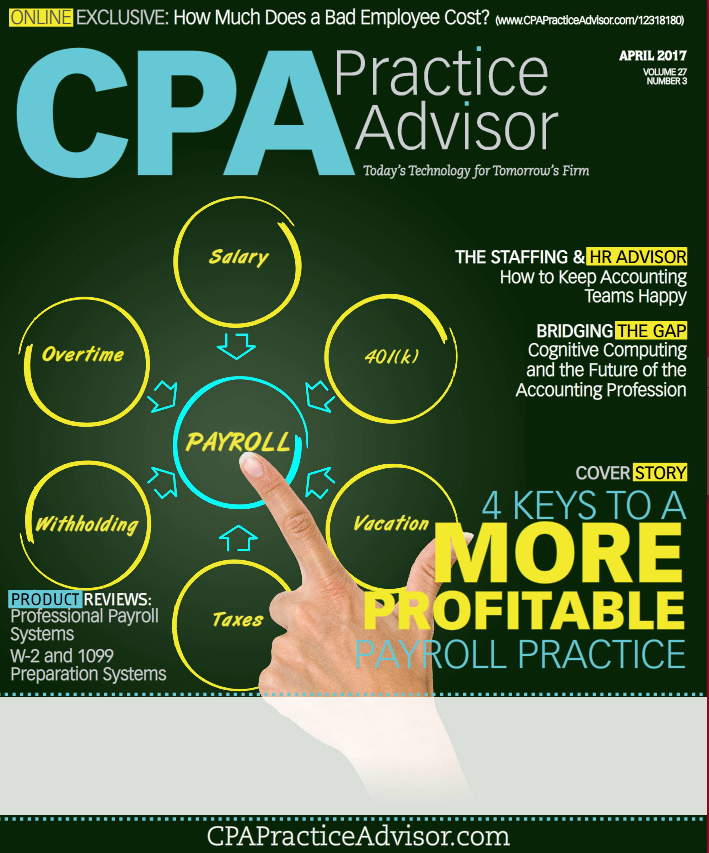

7 Payroll Best Practices of 2017

Payroll is one of the most crucial (but dreaded) tasks of any HR department. Not only is the collective payroll “check” likely the biggest expense your company incurs — it also goes to your most important payee: your team. Effective payroll ...

April 25, 2017

Tax Client Procrastination Can Equate to Fear

As you look back at tax season, for those of you who are tax accountants or even those who hear from your clients asking for recommendations for tax advisors, think about all of the frustration, grief, fear, stagnation, and bad judgment that came in ...

April 25, 2017

2017 Review of W-2 and 1099 Preparation Systems

What many business owners fail to understand is that processing 1099s is a year-long job, not one to start at year end. One company I worked for years ago had five staff accountants that had to dedicate eight hours a day for an entire week to process ...

April 25, 2017

April 2017 Payroll Channel

Payroll Channel – Latest News 3 Reasons Small Businesses Should Offer Retirement Plans:http://cpapracticeadvisor.com/12321406 How Much Does a Bad Employee Cost? http://cpapracticeadvisor.com/12318180 Tax and Payroll Legislation Updates for 2017:http://cpapracticeadvisor.com/12312786 Key Questions HR Leaders Need to Address Now:http://cpapracticeadvisor.com/12309159 Texas Legislature Considers Pay Equity Law:http://cpapracticeadvisor.com/12313090 Payroll Channel – Social Media Hiring Interns, The Legal Way –...…

April 25, 2017

Helping Your Clients Understand Basis for Tax Purposes

Sometimes, in dealing with clients, it is easy to slip into using tax lingo − terms that your tax professional colleagues are familiar with, but that may not be so recognizable to the average Joe or Jane. One of these terms is “basis,” and a little ...

April 24, 2017

Marketing to Restaurant Clients – It’s All about the Experience

With over $783 billion in annual sales in 2016, the restaurant industry might seem like a no-brainer as an accounting firm’s industry vertical. However, without the ability to speak the language they need to hear, you might be missing out and be ...

April 24, 2017

Creating Trust Through Change Management

Your firm is focused on improving your tax and/or audit process by leveraging Lean Six Sigma (LSS). LSS is a proven process improvement methodology used by many leading firms to improve their processes. Lean focuses on the speed of the process, Six ...

April 24, 2017

Apps We Love: Email Management

You’ve just spent your busy season juggling projects and are probably already thinking about how you could make your life easier going forward and in particular next spring. We’ve done some investigation and have requested input from members of the ...

April 24, 2017

Building an Accounting Niche in the Restaurant Industry: What You Need to Know

The restaurant industry has areas that are totally specific to it. Those who want to get into that area who want to do it right, need to become experts in those areas that really differentiate that industry.

April 24, 2017

Sales and Use Tax Incentives for Restaurants

With tax season ending, it’s a good time for restaurant owners to check in with their accountants to see what they qualify for this season and start preparing for next season. Common incentives for restaurant owners include utility and power credits.

April 24, 2017

Payroll Internal Controls Checklist

No matter the size of the company or how employees are paid, internal controls are a necessity. Here are my suggestions for payroll-related internal controls that can protect you and your data.

April 24, 2017

Payroll Record Retention Tips

A master list which includes the agency name, required records and length of time to retain is a good way to develop your own payroll record retention schedule.

April 24, 2017

5 Tips to Help Navigate Pay Equity

Leaders of accounting firms have joined a growing list of businesses interested in equitable pay practices. Specifically, expectations for greater transparency concerning equal pay for equal work are on the rise among employees, business owners, and ...

April 24, 2017

Helping Your Restaurant Clients Navigate Accounting Software

Running a restaurant presents a unique set of accounting challenges for many managers and owners. Issues such as transient staff, high transaction volume and theft are key concerns for restaurant owners, and having a robust system in place to handle these situations can go a long way. From general purpose accounting software to restaurant-specific accounting...…

April 20, 2017

4 Tips on Amended Sales Tax Returns

The majority of sales tax return filers are on a monthly filing schedule, so the opportunity for amendments happens 12 times a year. Even a solid sales tax operation can find itself in need of an amended return. Besides the hand-wringing that ...

April 20, 2017

Financial and Operational Reporting Ease and Excellence

We use technology tools to solve client problems and our own problems. Whether these are generic tools like Microsoft Office, Citrix ShareFile, or Square, or specific tools like Wolters Kluwer CCH ProSystem fx, Intuit Lacerte or AccountantsWorld ...

April 19, 2017

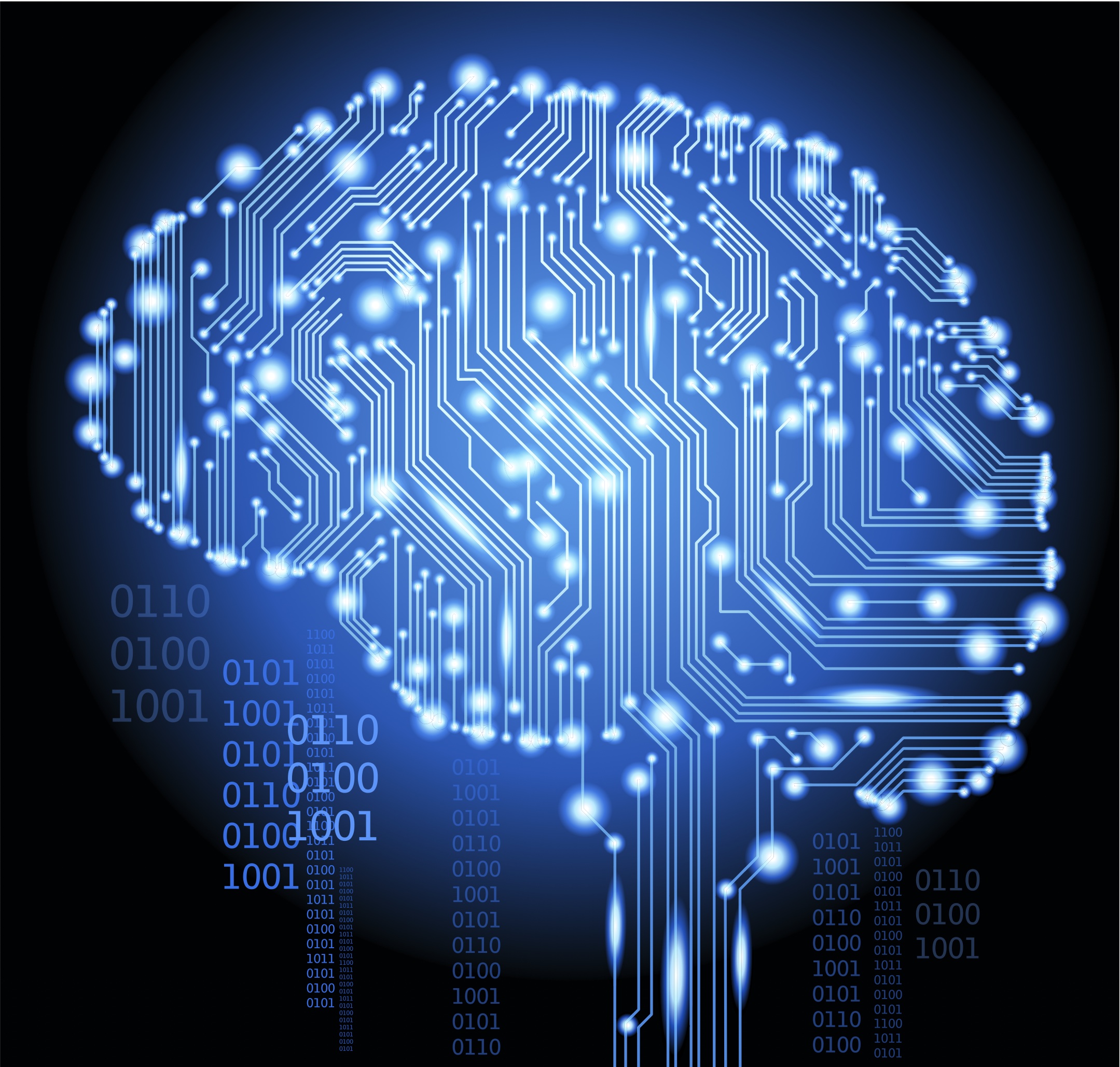

Cognitive Computing and the Future of the Accounting Profession

Cognitive computing is especially valuable in tax compliance, an area that is heavily regulated and often faces rapid changes. The process of preparing filings, ensuring compliance, and optimizing a business’ tax position is complicated, resource ...

April 11, 2017

How Accounting Firm Managers Can Help Their Teams Work Happy

Happiness at work is more important than many managers realize. Content employees tend to be more passionate about company goals, which means stronger performance, a higher retention rate, and fewer resources spent on hiring and training.

April 7, 2017

6 Tips for Measuring Time and Attendance

One of the most frustrating aspects of payroll can be measuring the time and attendance of employees. Here are a few tips for making it easier.